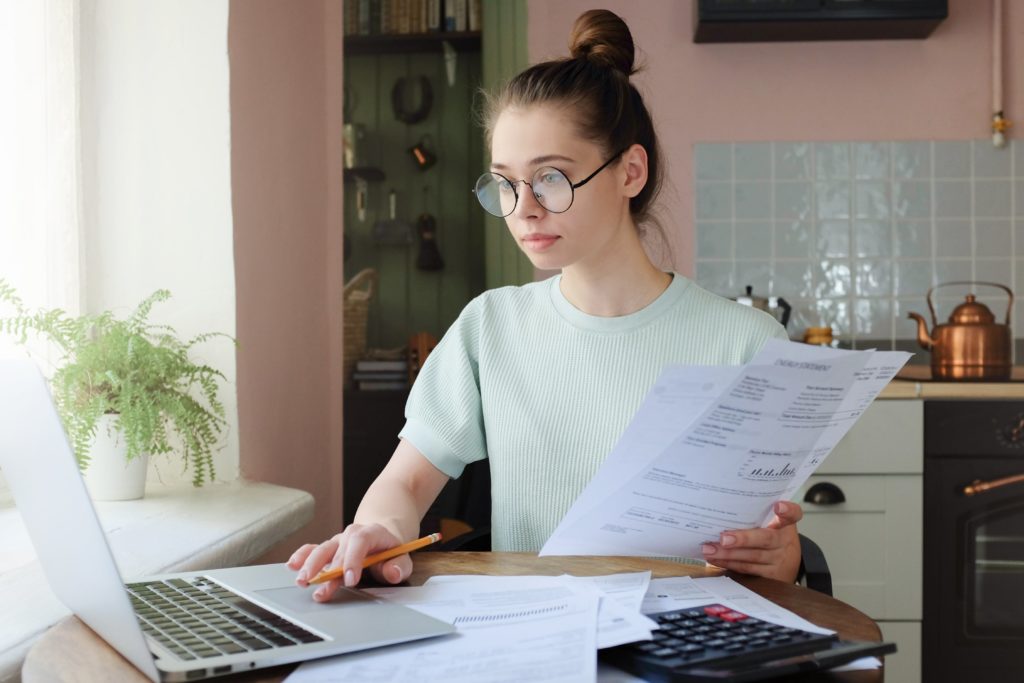

There are underlying expenses that help various operations run smoothly to ensure the company is profitable in business. Tracking such expenses can be challenging if you don’t have a reliable data collection system to streamline your finance department.

Additionally, you must ensure that your business is compliant with the tax regulations imposed by the government. So, having expense management software can save you the headache of proving your business compliance and simplify work for your financial controller.

Here are eight ways expense management software can improve business finances.

- Enhancing Business Efficiency

The traditional ways of expense accounting might be eventful and hard to audit. In addition, there are underlying overheads like printing and filing receipts that can be cumbersome for the finance department.

Such events can be frustrating and may need further evaluation by the taxman to prove the legitimacy of your business expenses.

With expense management integration in your organization, every internal and external expenditure follows a simple approval procedure. Anyone in the finance department can have personalized accounts to record all entries and account for funds allocated to them.

- Deters Fraud

Expense management software quickly replaces hard copies susceptible to manipulation by fraudsters. You can customize the settings to suit your business expense controls and track every cent through the systems.

In addition, you can have portals to separate internal and external expenses to avoid confusion when reconciling your expenditure accounts. You’ll avoid double entries and deter fraud within or outside your organization by evaluating and validating funding in your business.

- Streamline Cash Flow

It’s challenging to control cash flow in a business where financial management is non-existent. Worse still, not keeping records to show income versus expenditure. It becomes challenging to know if the business is profitable or at a loss.

Integrating expense management software can streamline cash flow and ensure your business is viable and can sustain daily expenses. It’s a helpful tool to identify if your business is growing or spending more than what’s at hand.

- Decision-making Tool

Businesses rely on data for various reasons and having a data collection point can help with the decision-making process. Expense management software is a good start and records valuable information for the finance department.

You can review how much your business operations take from your bank account and decide to drop the non-value adding expenditures like ordering take-outs for clients’ pets. You’ll reduce unnecessary expenses that are eating your capital base.

- Saves Time And Money

When you look at the approval processes in the traditional expense accounting setup, it’s defeatist to efficiency and productivity in your business. It becomes hard to transact with your organization since getting approval or clearance for simple expenses takes longer.

In addition, such delays may attract penalties from banks or creditors for not meeting the deadlines set on your loan facilities. Expense management software is intelligent and can alert you whenever your debts are due.

You’ll save time by expediting the payment processes and avoiding additional penalties.

- Promotes Transparency

When it comes to finances, transparency is a significant issue that you must tackle in your business. You must understand how funds expenditure affects your business operations. Spending more than you earn is counterproductive and may lead to a disastrous end to your business.

If you allocate funds for projects or operations, anyone handling money in your establishment can line up their request in the expense management software. It simplifies traceability, and everyone using the system can see what everyone else does with funds allocated to them.

- Improves Report Presentation

Preparing expense reports can be tedious and laborious for the finance department to explain if they don’t have a working system. It’s even more challenging for the management to present their case to the taxman.

In-cooperating expense management software can save you a headache since it records and stores the data entered into the system. You can quickly generate reports that produce substantial evidence of money spent in your financial period.

- Promotes Compliance

Compliance is perhaps the most crucial part of running a business that you must aim to achieve. Financial audits from the regulators will comb through your account books to ascertain your income versus expenditure.

Gaps in your accounting systems will automatically send non-compliance alerts to the authorities. Such events are avoidable if you use expenses management software to ensure your expense entries are valid and within your business frameworks.

Conclusion

Technological advancement is a fast-changing underlying accounting process to improve business output. Innovations such as expense management software provide a perfect solution for the finance department to control and account for every cent spent. It enhances transparency and traceability to ensure your business is viable and sustainable throughout its operations.