Sean Frank is the founder of Cloud Equity Group, a New York-based investment management firm specializing in leveraged buyouts of tech-enabled business service providers. Like many investment management firms in New York, Cloud Equity Group invests millions of dollars annually in private companies to improve the businesses and help them scale. However, unlike most investment management firms in New York, the mastermind behind Cloud Equity Group’s success is just in his early 30s – significantly younger than most of his peers on Wall Street.

Sean’s lengthy track record began well before most of his peers. At the age of 12, Sean started his first company – a web hosting provider. At the time, Sean wasn’t even fully aware of what he was doing. He simply liked the idea of earning money at home and saw an opportunity during the tail-end of the dot com boom to help individuals and small businesses develop an online presence. As time went by, what started as just a small web hosting company grew quite significantly. By the time Sean graduated high school, he was running a conglomerate offering a vast array of web-based services from traditional web hosting all the way to outsourced IT staffing.

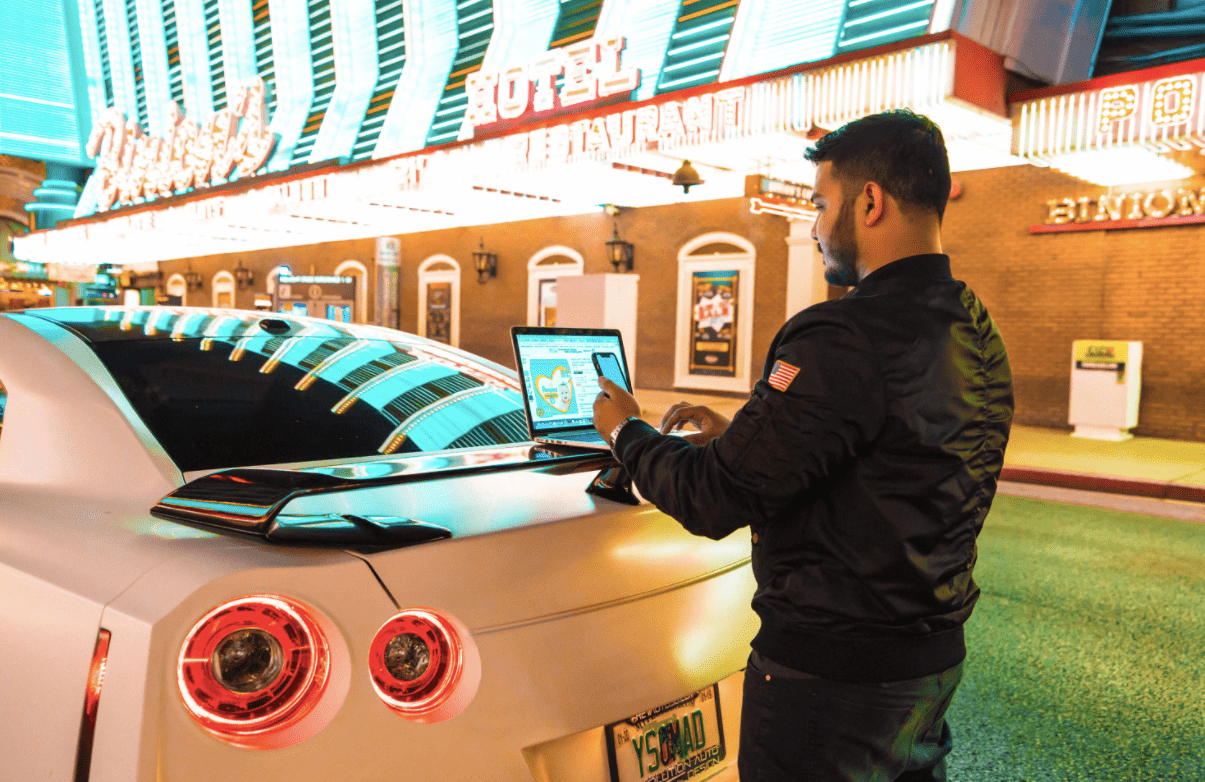

At first, Sean was learning from trial and error – as a middle school student he had no real relevant education in running a business or even experience working for one, he had very little advanced knowledge or guidance. By the time he reached high school, Sean had built a business organically that was earning him more money than his teachers while working from the comfort of his home. When speaking about it, Sean said, “Being a young CEO was really an amazing feeling. I’d go to school and afterschool sports like a normal student, and then I’d come home to check on my team and the daily business operations.”

While in high school, Sean became connected with Andy McKelvey, the founder and former CEO of Monster.com. “Andy became a mentor and helped teach me how to really legitimize my business,” said Sean. In addition, Andy, who was a principal at a private equity firm at the time, taught Sean how he could grow his business inorganically by acquiring his competitors. Over the next several years, Sean completed dozens of acquisitions to rapidly scale his company.

Fast forward to 2013, Sean founded Cloud Equity Group – an investment management firm designed to continue to execute the same types of transactions that Sean had been doing for the previous decade. This business undertaking marked Sean as the first fund manager of dividend-focused investment vehicles specializing in the web and cloud hosting sectors.

Even though some may find it hard to believe, Sean points out that few of his business ideas were planned out in advance. He saw an opportunity at a young age that he could capitalize on, and he worked incredibly hard to do so. In a talk Sean gave at Harvard Business School to entrepreneur students, he discussed how hard he worked to reach his goals – often having sleepless nights and skipping out on countless social events. He explained that it’s not easy to build a successful company and you really need to be dedicated to it 100% if you want to work.

When asked what piece of advice he would give to all aspiring entrepreneurs, Sean said the following:

“You need to be willing to put your business venture ahead of everything else, and to understand that it’s going to take time to develop. If your business can’t be your number one priority in absolutely every sense of the word, you really need to evaluate if you are hungry enough to make your idea a reality.”