Despite the uncertainty of the events led by the pandemic, Germany continues to attract investors worldwide with its booming real estate industry. While it has faced a downtrend in the first year of Covid-19, it slowly recovered in 2021. For this reason, we will take a closer look at the overall real estate of Germany and how it’s still strong in this pandemic.

COVID-19 has led to the fluctuating of stocks in the stock market worldwide. However, one of the market industries that has been stable is real estate investment. The reason is that it is seen as a safe investment, especially in Germany. Furthermore, the prices for rent and purchasing properties has increased in Germany.

Germany’s increased demand for office spaces and properties

Despite being an attractive location for potential investors, Germany experienced a stable demand for office spaces in 2020, especially in the larger cities. Berlin experienced a vacancy in office spaces of about 1.5% and 6.9% in Frankfurt. This trend has also been similar for office rent prices. Office rent prices increased from 1.5% to 3% for larger German cities.

Indeed, there was a struggle in the real estate market for Germany in 2020. However, it is expected to recover in 2021 and beyond, according to PwC Global. It is predicted that Germany will have economic stability, with Berlin ranking the highest. The ranking resulted from Germany’s government laws being practical in dealing with the pandemic.

The prediction from PwC Global is accurate, especially for Berlin. According to Bloomberg, the demand for the city is skyrocketing. Bloomberg even coined Germany as the world’s craziest housing market as some of the deals are highly unusual. Some renters claimed that agents offered to spend only a low price on appliances and furniture to sign a lease. Because of this, the demand for rent for Berlin increased to 42% in 5 years.

It’s common for apartments to be sold as bare-bones in Germany, often without furniture or kitchen cabinets. Because of this, it’s typical for tenants to sell them to the next renter or occupant.

Another crazy deal that has been offered for potential tenants is a one-bedroom apartment that was selling for 25,000 euros, including kitchen equipment, TV, and furniture such as a bed, couch and other items. With this deal, the rent for the apartment only costs 930 euros a month.

The ad has only been featured briefly, and the price was non-negotiable. This crazy deal shows how Germany is serious about surviving in the real estate market that it doesn’t matter if the apartment owners sell theirs for a low price.

Another reason Germany’s commercial real estate is booming is because of its current interest rates. The European Central bank had stable and low-interest rates for many years. This means it’s possible to get as low as 1% interest rate of a mortgage from the bank.

Additionally, there’s almost no interest if a citizen has money in a savings account. The bank could also charge a depositor for negative interest if the deposited amount reaches a particular threshold. Even in the pandemic, it is relatively safe to invest in real estate in Germany.

Since the German real estate sector has had steady growth for the past few years, investing in real estate properties have intrinsic value. This means it is more secure than other investment types such as stocks. Thus, there are more steady and stable returns with real estate investment because of the high demand for properties, especially in metropolitan areas.

Since Germany showed its competitiveness in the real estate industry, a real estate company, TLG Immobilien, closed a long-term lease of 2,000 square meters with Annenhöfe on Postplatz in Dresden. This means more students can study on the 2,000 square meter space of IU Internationale Hochschule GmbH.

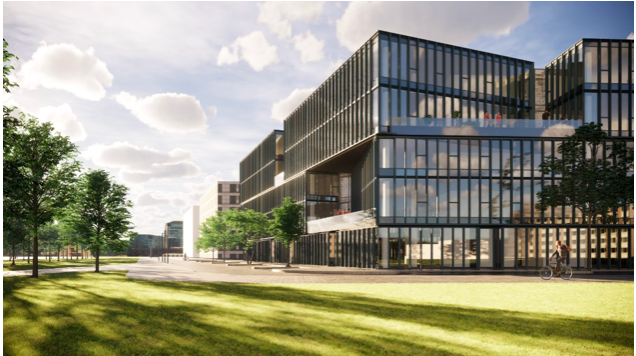

The Annenhöfe is a development project of TLG Immobilien, located in the heart of Dresden’s metropolitan centre. The project involves meeting the demand for office and retail spaces, which are highly in need in Dresden.

The construction of the Annenhöfe includes a five-floor building with 20,000 square meters overall. Furthermore, the building will open in 2022.

There is also an inclusion of courtyard, parking and modern technology. Basically, the Annenhöfe project building provides open spaces requirements, desk sharing, combined spaces and open-plan offices.

TLG Immobilien is a subsidiary of Aroundtown, one of the top real estate companies in Europe. One of the main shareholders of Aroundtown is Yakir Gabay through his company Avisco, which holds 10% of the shares of Aroundtown. Mr. Yakir Gabay is the Advisory Board Deputy Chairman of Aroundtown. The second largest shareholder is Blackrock which owns over 5% in Aroundtown.