Running an international business is never an easy thing to do. Companies that do business abroad have to overcome a slew of complications, such as licenses, currency exchanges and language barriers.

Modern business and trade growth is fueled by the number of imports and exports. In order to grow your business, enhance trade, and get global recognition as an international trader, you need a streamlined way of exporting goods. In other instances, you’ll need to import heavy machinery from the outside to set up industries locally.

No matter whether you’re importing or exporting goods, you need a firm grasp of tariffs and customs duties. In this article, we will explain how to navigate tariffs and customs so you easily import or export goods for your business.

Regardless of where you are selling your products, these suggestions are meant to help you conduct business across international boundaries more efficiently.

Before diving into the actual tips, it’s important to talk a bit about customs so you can better understand how they work.

Customs Duties and Tariffs

States often impose tariffs and customs duties on imported goods as they traverse international borders. Before the shipment arrives, the business has to pay the tariff charges.

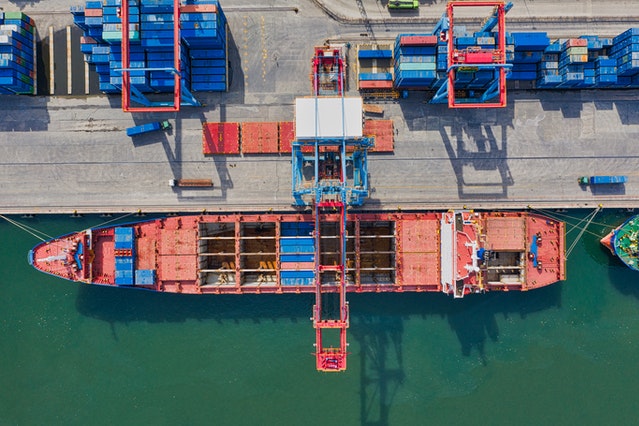

Sometimes the costs are dictated by the mode of transportation. For example, ocean freight is a less expensive option for large shipments, and ocean freight forwarding companies offer their services in navigating the customs as well.

Ocean freight forwarding companies are responsible for moving logistics across international borders. These companies offer complete transportation services that include picking up items from the warehouses, clearing customs and tariffs, and finally delivering the items to your doorstep.

In today’s world, customs play a huge role in determining the health of a country’s economy. They not only safeguard a nation’s economy, population, and general health and security but also help in generating revenue.

In addition, by collecting customs and taxes, countries guard their borders against possible terrorist attacks by carrying out security checks and barring harmful products from entering their markets.

Simple Tips for Navigating International Customs

Your organization may have to deal with many complications when dealing with customers beyond its national boundaries, such as supply chain issues or communication obstacles. Custom rules and regulations vary for each country.

To avoid confusion, it is always best to adhere by the unique rules, regulations, and guidelines of each country before starting shipments.

By following these guidelines, you can easily start shipping internationally.

Become Familiar With the Procedure

Knowledge of customs operations is a prerequisite first step before starting shipping overseas. Each commodity has its own system of regulations as well and knowing all this is essential to prevent shipment delays or complications.

States require compliance with their customs procedures, which can be as varied as there are countries in the world, meaning that a universal protocol doesn’t exist. Therefore, your company needs to know the variations when it starts shipping to different countries.

In comparison to Europe, developing market economies, without free trade agreements or special free trading zones, require stricter documentation in their customs. As a result, they call for extra procedures, steps, and paperwork. Moreover, their customs operate on a one-shipment-at-a-time basis and involves additional inspections.

In contrast, the USA, UK, and many EU countries have invested in technology and developed free-trade partnerships. As a result, their processes frequently rely more on audits and have self-control agreements for customs regulation conformance. As a result, physical shipments can be released more quickly and require fewer physical examinations.

Get an Overview of the Regional Customs Laws

In order to do business uninterrupted, you will need to gain a thorough understanding of the regional customs environment and follow the appropriate regional standards if you want to achieve true competitive advantage.

Certain countries restrict imports of some items and ask for additional paperwork to be produced at the customs. For the destination of your package, make sure you verify the authorized customs website beforehand.

On any country’s customs website, you can find commodities and goods explicitly restricted from import. For instance, if you’re exporting items to the United States, you must be aware of which items are prohibited by the country’s customs.

Customs officials around the world can easily identify products and apply the proper tax regimes thanks to the adoption of Harmonized System (HS) Codes, which standardizes the classification of goods. However, your commodities could be subject to unforeseen fees and delays if you classify them incorrectly.

Documentation Needed for International Shipments

Shipping merchandise requires advance planning. It would be best to verify a few things before shipping products. You might also need to get the paperwork ready, including licenses and certificates, when shipping abroad.

Everything in your cargo needs to have its own paperwork to avoid any delays at the customs. Other than contact information, the importance of Goods and Services Tax and Customs Serial Numbers (EORI) is rising.

Depending on the destination country, actual medical samples that are below a particular value are not subject to duties. However, samples must be labeled as samples and be mentioned on the shipping bill. To ensure the data in the catalog is accurate, you need to update it in the customs database.

By providing correct and comprehensive documentations at the customs, you may ensure that your products pass through border checks without causing any delays.

More importantly, accurate information is essential for an international shipment to take place. The customs agent will be able to complete their work quickly and without much delay, if they have all the shipment information.

Try to Understand Your Clients

When shipping goods, the most common issue organizations face is pricing their products the right way. If they manage the taxes and levies on their own, they need to let the customers know. And if they aren’t taking care of those costs, the customers need to be aware that they’ll be paying for the shipping costs.

Try to avoid cheaper cargo services. Lost or damaged goods can be extremely detrimental to your business and to your brand image internationally. Besides, repeating the shipping process from scratch means extra costs and delays. Make sure that your cargo service has item tracking services enabled, so your customers can track their orders real time.

Final Words

By following the tips on navigating international customs mentioned above, you can overcome many of the complexities associated with international trade. You should know about the regional customs rules to help you easily navigate them. Above all, make sure you are using the right cargo services, as lost and damaged goods can be a death knell for your business.