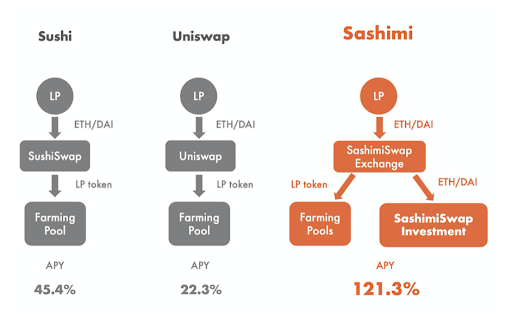

Ever since its launch, SashimiSwap by the developers of aelf has seen a lot of attention. Thanks to the Automatic Market Maker (AMM) model, SashimiSwap is ensuring users have enough investments and profits in their hands. Sashimi’s product multiplies the income of liquidity providers (LP) via intelligently crafted DeFi products.

Anyone who seeks idle income can access SashimiSwap and be a part of its staking and mining. Extra income can be made by automatically re-investing a part of their liquidity funds which multiplies the users’ returns. Every user’s automatic re-investment will happen on established DeFi platforms that will yield greater profits than leaving funds stagnant in one pool.

In the past few months, SashimiSwap has undergone various upgrades working in favour of its users. It started off as a liquidity mining platform, then added a decentralised exchange with an AMM mechanism and now also helps one to earn more income via investment and vaults. So, there’s every reason for users with idle funds to invest in it over alternative DeFi solutions

SashimiSwap is profitable to users:

The only interest many investors have about SashimiSwap Investment is how it helps to multiply income as liquidity providers (LP). But there’s more to it than meet the eyes. It expands users’ idle funds in a liquidity pool that are invested. Different assets like ETH, DAI, GT, and others look after them with the help of various DeFi products. Overall, the investment and the assets help in growing the income for liquidity providers.

If you wonder how much population can enrol on the SashimiSwap investment scheme, we have intriguing data for you. As reported till October 2020, around $10 billion of liquid assets in the DEXs are idle funds. Out of this, $2.8 billion covers the Uniswap accounts. If these idle assets are enrolled to SashimiSwap investment, users will have their own place in the financial market as an investor and earn profits.

After the user earns their profits with SashimiSwap Investment, they can buy back the Sashimi. 25% of Sashimi from the buyback is sent to the Sashimi Bar, and 75% will be sent to the Timelock address or Sashimi Treasury. The Sashimi tokens help the liquidity providers to redeem it and take their share of profit earnings. Similar benefits are witnessed in the SashimiSwap Vault.

SashimiSwap Vault is an aggregate financial management platform in which users can invest in other DeFi products with the staked asset. The contract of the Vault benefits the users through the DeFi platforms that will help them gain tremendous yield with maximum returns (AAVE, compound, YFI, Synthetix, etc.). To earn these benefits, the users have to deposit the corresponding UNI-V2 Token, DAI, ETH and USDC in the SashimiSwap Vault pool. Once they make the deposit, the svUNI-V2 Token further helps the users with staking voucher.

SashimiSwap services and benefits don’t stop here. If you are unaware, Sashimi also aims at community governance and voting. For the voting procedure to happen, users have to use the SASHIMI-ETH SALP token they obtained from their liquidity (i.e. sashimichakra). Then, users can either add a proposal on the platforms and vote for the proposal to make the voting happen. The voting period is variable, but the total voters should be at least 30% with 60% voting for yes. If that happens, the proposal gets passed.

As informed above, SashimiSwap is accessible to anyone with idle funds to make them one of the liquidity providers. If there’s more you want to know, check out the website: https://medium.com/sashimisashimi.